Ship Repair and Maintenance Services Market Size Worth USD 60.38 Billion by 2032 | Driven by Aging Vessel Fleet and Rising Seaborne Trade

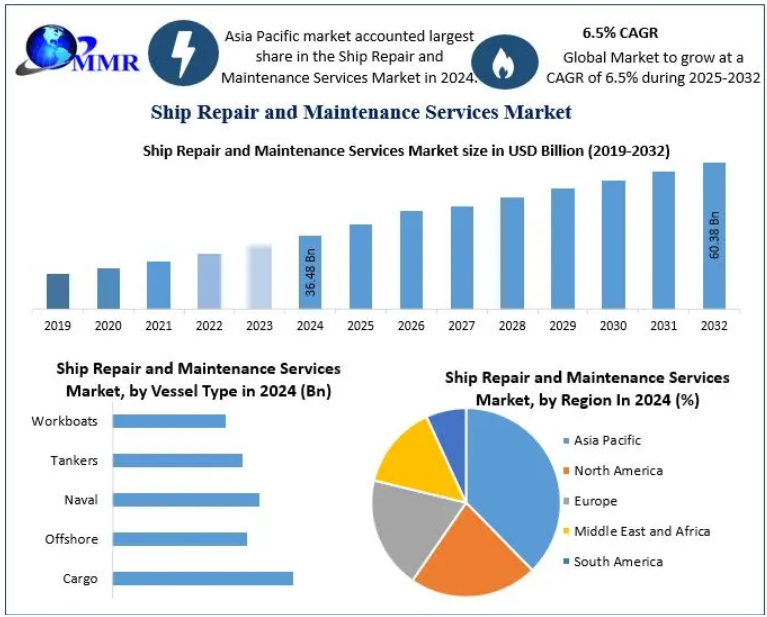

The Ship Repair and Maintenance Services Market was valued at USD 36.48 billion in 2024 and is projected to reach USD 60.38 billion by 2032, growing at a CAGR of 6.5% during the forecast period (2025–2032). This growth is fueled by increasing global seaborne trade, government support for shipyards, and technological advancements such as IoT-enabled maintenance solutions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/104905/

The ship repair and maintenance sector plays a critical role in supporting global maritime operations by ensuring the reliability, safety, and efficiency of vessels. Although the market faced a temporary downturn due to COVID-19 lockdowns and supply chain disruptions, it has since rebounded, backed by expanding trade volumes, aging fleets, and favorable policy frameworks across major maritime economies.

Shipyards in several nations benefit from tax incentives and financial aid aimed at strengthening domestic shipbuilding and repair capabilities. For example, Malaysia’s Ministry of International Trade and Industry offers tax breaks for ship repair enterprises, while the U.S. Department of Maritime Administration funds small shipyard projects to enhance infrastructure and workforce training. Similarly, India’s government has granted shipbuilding and repair activities infrastructure status, promoting industry expansion.

Rising Seaborne Trade: Over 90% of global trade depends on maritime transport, increasing the demand for vessel upkeep and modernization.

Aging Vessel Fleet: A growing proportion of vessels are over 20 years old, heightening the need for regular maintenance.

Government Support and Tax Incentives: Policy measures across Asia, North America, and Europe are encouraging investment in ship repair facilities.

Technological Integration (IoT): The use of IoT-enabled sensors and analytics is transforming predictive maintenance and operational efficiency.

High Maintenance Costs: The cost-intensive nature of ship repair activities continues to hinder small operators.

Limited Marine Exports in Some Regions: Countries with weak shipbuilding infrastructure experience slower market growth.

IoT technologies enable real-time monitoring of ship systems, optimizing maintenance schedules and reducing operational downtime. Ship repair companies are increasingly adopting IoT-based solutions to track engine performance, fuel efficiency, and equipment wear.

To reduce environmental hazards, shipyards are moving away from abrasive shot blasting toward ultra-high-pressure water blasting systems. This technique, adopted by companies such as Watex Corporation, offers sustainable cleaning with water recycling and zero chemical waste.

Cargo Ships – Dominating segment with ~60% market share; driven by global commodity trade and logistics demand.

Offshore Vessels

Naval Ships

Tankers

Workboats

Electrical and Instrumentation Repairs – Fastest-growing category due to the need for motor, generator, and control system maintenance.

Mechanical Repairs

Main Engine Maintenance & Repairs

Emergency Repairs

Underwater Cleaning and Repairs

Dockage – Expected to grow at a CAGR of 7.7%, boosted by increasing port infrastructure modernization.

Hull Part Repairs – Estimated CAGR of 7.3% driven by corrosion control and fuel efficiency needs.

Engine Parts

Electric Works

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/104905/

Holding a 50.9% market share in 2024, the Asia Pacific region dominates the global ship repair and maintenance services market. China, South Korea, and Japan lead shipbuilding and repair operations, accounting for over 93% of the world’s ship construction. The region benefits from rapid economic growth, tax incentives, and robust seaborne trade.

These regions are witnessing steady growth (CAGR of 2–3%) owing to expanding marine commerce, port development projects, and rising investment in offshore infrastructure.

Both regions are seeing renewed interest in naval ship maintenance and modernization programs, particularly in the U.S., Germany, and the U.K.

The global ship repair and maintenance services market is highly competitive, featuring established players and emerging regional firms. Key strategies include mergers and acquisitions, technological innovations, and expansion into high-demand regions.

Major Players Include:

Cosco Shipyard Group Co., Ltd

Damen Shipyards Group

Hyundai Mipo Dockyard

Cochin Shipyard Limited

Hanjin Heavy Industries

China Shipbuilding Industry Corporation (CSIC)

Sembcorp Marine Ltd

Fincantieri S.p.A

Keppel Offshore and Marine

United Shipbuilding Corporation

Oman Drydock Company

Arab Shipbuilding and Repair Yard

Orskov Yard A/S

Tsuneishi Holdings Corporation

Dae Sun Shipbuilding & Engineering Co. Ltd

For instance, Titan Acquisition Holdings’ acquisition of Huntington Ingalls Industries in 2024 strengthened its defense-oriented ship repair capabilities, while Hyundai Mipo Dockyard secured a KRW 110 billion contract from Evergreen Marine for eco-friendly container ships.

The Ship Repair and Maintenance Services Market is set for robust growth through 2032, driven by digital transformation, sustainability trends, and expanding global trade. Asia Pacific will continue to lead, while Europe and North America will see modernization-led opportunities.

With governments actively supporting shipyard development and operators embracing IoT and green technologies, the industry’s long-term outlook remains highly optimistic.

| Categories: | Vehicles / Boats & Watercraft |

| Phone: | 9834510596 |

| Address: | 3rd Floor, Navale IT Park, Phase 2 Pune Banglore Highway, Narhe, Pune, Maharashtra 411041, India |

| Email: | supriyamaximize1@gmail.com |

Member since October 27, 2025

View All Ads Send Message